The booming life sciences industry, whose investment in corporate research and development spending more than doubled during the last decade to $212 billion in 2020, is giving birth to millions of square feet of new research laboratory space in the U.S.—29 million sf in 2019, up from 17 million sf in 2009. Much of that recent growth is in gene and cell therapy R&D.

Regulatory approvals of the first gene therapies in 2017 and an expectation of commercially viable treatments are driving the growth, says Peter Walters, director of Advanced Therapies at CRB in Carlsbad, Calif. Hundreds of research studies are in progress to test gene therapies to treat genetic conditions, cancer, and HIV/AIDS, according to the National Institutes of Health. That means that the rising demand for space is expected to continue. “For all of these companies—I think over 1,200 worldwide—everyone who is coming out of R&D and going into a clinical phase one, certainly a phase two, is looking for a new build. So, there is a tremendous market shortage of cleanroom space, and of warehouse space that can be converted into laboratory space,” says Walters.

This demand can be met with newly built facilities or those constructed in a repurposed building that has proper utilities, and can range in size from 30,000 sf to 200,000 sf, says Sara Eastman, principal and director of Science and Technology at EwingCole in Philadelphia.

With the fast-moving science for drug discovery and the growing marketplace for new therapies, it’s important to consider all the factors that scientists need, from R&D to manufacturing. “The traditional eight-year timeframe from discovery to commercialization is getting halved. A building can’t take two or three years to get built, because by the time it is built, you are already into commercial production,” says Walters.

Considering research requirements when designing laboratory spaces enables planning teams to discuss the features the spaces will have to accommodate, says Walters. “That allows the team to start to define things like equipment and utility requirements, who needs to hand off materials to whom when taking samples, where those samples have to go, and how critical is it to meet certain timeframes,” says Walters.

“How many workstations do you need to produce your throughput? Or if we have this amount of square footage, what kind of throughput can you get? How many operators do you think you are going to need? How many quality control (QC) stations? How big does your QC lab or your warehouse have to be to support it? This creates avenues of discussion, some framework to the conversation, so we can make more informed decisions,” says Walters.

For example, some facilities require strict protocols and speedy handling of biological materials that designers can account for before construction begins. “A lot of times for cell therapy, you want that program to be adjacent to your shipping and receiving. Because if you are receiving patient cells, that is a very critical handoff that has to be tracked and traced through your whole facility,” says Walters.

Science Informs Design

Understanding the aspects of the science performed in the facility can help designers and construction teams build productive spaces. The two types of therapies generating demand for cleanroom manufacturing space are cell therapy (injecting grafted or manipulated cells) and gene therapy (repairing or reconstructing the genome, and then providing doses of this material to the patient), explains David Keith, EwingCole’s regional director of Science and Technology in San Diego.

Scientists deliver these therapies into a patient’s cells using a virus, which can efficiently transport their genomes inside the cells they infect. This “viral vector” is a tool commonly used by molecular biologists to deliver genetic material into cells.

There are two types of donor cells used in these new therapies: Autologous and allogeneic. With autologous cells, the patient is both the donor and the recipient of the therapy. Allogeneic cells, on the other hand, come from multiple donors, and the resulting treatment can be given to a group of patients.

The manufacturing of these therapies involves the banking and freezing of cells to preserve them. The industry has adopted equipment to make the manufacturing process efficient, such as single-use bioreactors.

Facility designers can map the flows of people, material, and waste through the space depending on the kind of therapies researchers are developing, and whether the organization is developing multiple therapies in the facility. “For cell therapy and gene therapy, these factors are very critical. There is a very real opportunity for cross contamination when you are working with viral vectors in gene therapy, especially if it is a multiproduct facility,” says Walters. The right floorplan can mitigates this risk, he says.

Another key factor is building in flexibility so a company can pivot from clinical trials to manufacturing. “Once you find a therapy that has commercial potential, that timeline moves very quickly,” says Walters.

“The environment required to do commercialized manufacturing for a cell therapy has to be very different from what is done in the R&D sector,” he says. “It is important to not only have an innovative and collaborative environment, but also have the mental mindset to be thinking forward to what commercial manufacturing wants to look like.”

In practice, it helps to create two levels of criteria through which to analyze the operational needs of the clinical or commercial manufacturing, says Keith. In addition to the staffing levels in the facility, the first level of considerations include:

- The type of work involved, such as autologous or allogeneic, and whether the manufacturing cleanroom suite is producing viral vectors to deliver therapies to patients – Autologous processes historically involve more manual work in biosafety cabinets although technology advancements are introducing automation to previously manual processing steps.

- Equipment and technologies used, including automated bioreactor systems, CliniMACS®, and other equipment to produce viral vectors – Manufacturing of allogeneic therapies and viral vectors offer more potential for automation due to the larger batch sizes than autologous research.

- The expected speed-to-market for the therapies under development – Autologous products require less site infrastructure and are potentially the quickest path from R&D to market. Allogeneic therapies require more support spaces. Viral vector processes generally call for a larger manufacturing facility with more equipment.

- The volumes of material the manufacturing facility will produce – Autologous facilities produce blood bags for plasma. Allogeneic processes result in bags, vials, and syringe-level quantities of compounds. Viral vector facilities might require containers that can hold between 100 and 4,000 liters.

- Ability to increase capacity – Manufacturing of autologous and allogeneic therapies require enough spaces for individual workstations or suites. Viral vector processes require space to grow as needed.

- The flows of people and materials within the GMP manufacturing footprint – A unidirectional flow is the preferred model, because it reduces contamination risks. Bi-directional flows are possible, but they require added administrative protocols to prevent contamination.

Drilling down to specific manufacturing facility features, Eastman says that design teams can find value in creating “bubble diagrams” to show relationships among the different types of spaces in the manufacturing suite, including where equipment is located, and how people and materials flow through the space.

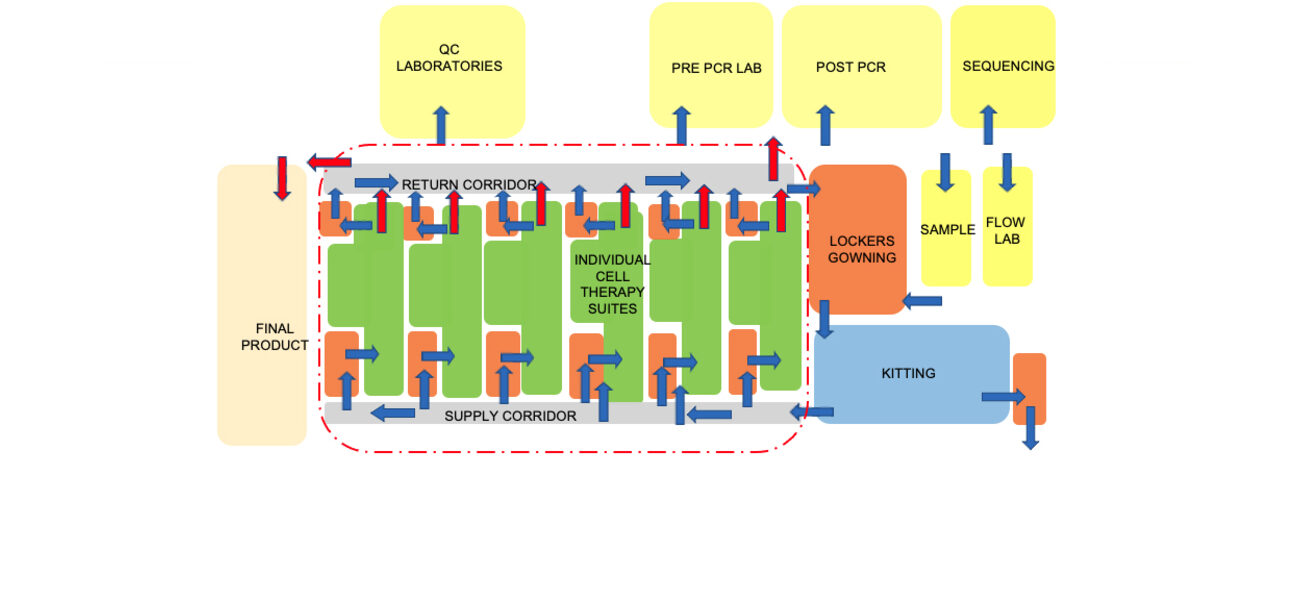

For example, a bubble diagram design for an autologous project focused on individualized cell therapies shows numerous processing suites, explains Eastman. To reach those suites, a manufacturing technician would travel from a locker room to gowning, through a supply corridor, to the suite. They would then leave through a return corridor. An allogeneic facility design flow would include spaces for upstream processing and purification in addition to space for corridors, gowning areas, etc. The diagram also indicates the outer boundary of the GMP space where the processing work occurs. Support spaces such as quality-control labs typically reside outside that ring.

The following quality controls are paramount in life sciences laboratories, says Keith:

- Mitigating contamination risks in processing suites – For example, if unidirectional flows of people and materials are not possible, planners will include sufficient spaces for alleviating cross-contamination, and the facility will have an overlay of administrative controls for managing material and personnel movement through the facility. An example of an engineering control is segregating processing suites (from both a layout and a mechanical perspective) so each is independently operated. That way an issue in one suite doesn’t shut down the entire manufacturing facility.

- Maintaining a strict separation between GMP and non-GMP spaces – Design features can help everyone know the boundaries of manufacturing and processing work areas, the requirements for chain-of-custody with therapeutic materials, and procedures to handle samples.

- Managing bio-waste protocols – If done on site, designs must provide space for waste containment and neutralization. If off site, there must be adequate storage for the outgoing waste.

Where and How to Build

Even though market demand creates pressure to open new labs as soon as possible, not every parcel or empty warehouse is suited to the purpose, says Michelle Gangel, R&D market director at CRB in Kansas City, Mo.

For example, the right location—with access to nearby amenities, labs with views to the outside and a collaborative and engaging feeling—can help attract highly sought-after life sciences workers. “It’s not just about having a facility that can functionally do the R&D or do the process. The quality of the workplace means so much more in this market sector than in a lot of others,” says Walters.

And the biological materials need to reach patients quickly, so R&D teams in early clinical trials benefit from proximity to a hospital, says Walters. “A lot of autologous-based companies are locating near airports or major travel infrastructure because they need to have that avenue to transport those cells rapidly and reproducibly,” says Walters.

Other issues in existing facilities present challenges, too, says Gangel:

- Plumbing systems that can’t accommodate the needs of the laboratory.

- Column grids that are too close together to provide the open spaces labs require, and ceilings that are not high enough to accommodate both the lab equipment and the utilities they require, ideally 15 feet floor-to-floor for labs and 16 feet for cleanrooms. Ceilings that are too high, however, can lead to extra expense for hanging ductwork and installing sprinklers.

- Mechanical systems that are inadequate for labs.

- A roof structure that requires reinforcement in order to support new mechanical equipment, which necessitates installing new columns.

- Parking that fails to meet local zoning rules or cannot accommodate truck loading, or, if applicable, space to deliver modular building units.

- Regulatory controls on use of chemicals, particularly in multi-tenant buildings can be problematic where one tenant can use up the quantity permitted for the entire building

In addition to picking the right location, it is important to select the optimal construction method, says Walters:

- Stick-built is the historic way of erecting a building with studs and drywall. Pros: least expensive, most flexible in terms of design choices, and long-lasting. Cons: time-consuming to execute

- Modular panel system – Wall panels built off site are assembled on site. Pros: Speeds construction in any existing structure, though the panels often require the creation of a mezzanine space to hold mechanical equipment. Cons: The panels are not reusable and will likely be damaged if disassembled.

- Fully modular systems are like “cleanrooms in a box,” built in a factory and delivered for installation. Pros: high quality at a faster speed. Cons: the most expensive. “You might add a 20 percent premium to pick up 20 percent of the schedule. They are also the most complex to incorporate into an existing facility structure.”

By Michael S. Goldberg