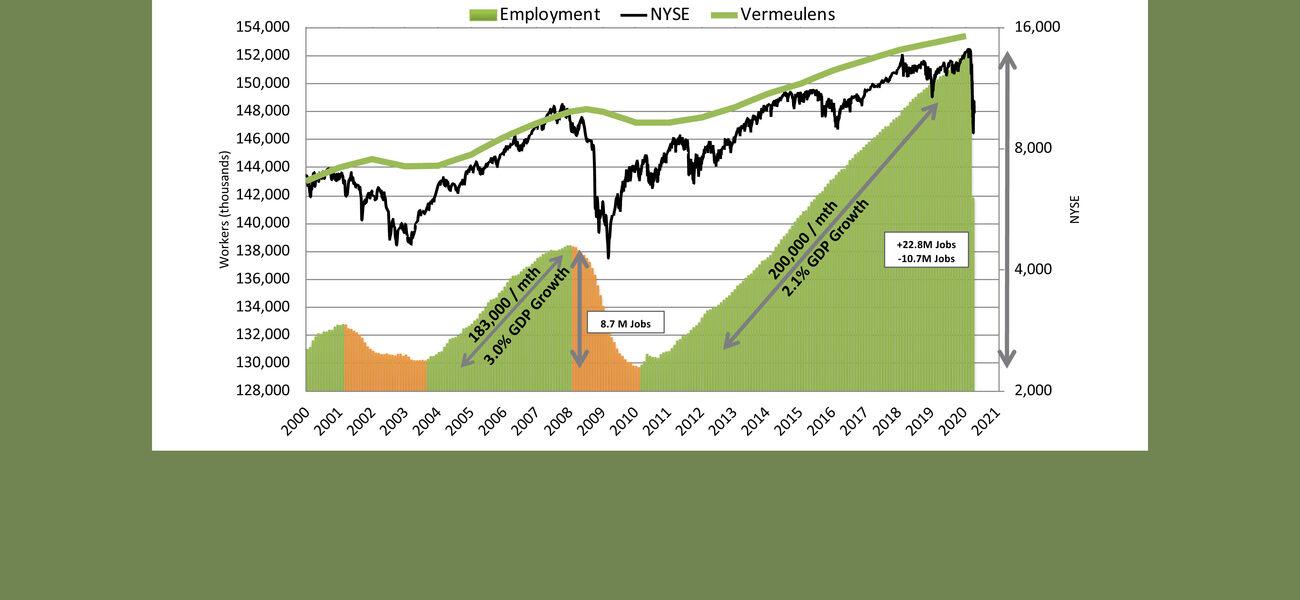

To keep apprised of the dynamics in the current construction environment, Vermeulens, a professional services firm focused on construction cost estimation and pre-construction cost control, has scheduled twice-weekly virtual roundtable discussions with industry leaders in Central and East Coast regions to identify ongoing trends, influencing factors, construction administration issues, and the market outlook in the construction industry. Economic indicators are in flux, and while employment in construction seemed to have avoided the drop seen in other sectors through mid-March, a survey conducted by the Associated General Contractors of America (AGC) shows that conditions are worsening, with 55 percent of the 1,600 repondents nationwide reporting they had been directed to hault work on at least one project, and 27 percent have furloughed or terminated construction workers. The next federal jobs report, which will be issued at the end of April, will provide a truer picture, says James Vermeulen, managing principal of Vermeulens.

“The underlying economic fundamentals going into this pandemic were strong, unlike during the financial crisis,” says Vermeulen. “A lot will depend on how long it takes to work through the pandemic. The longer that takes, the longer it will take for the economy to bounce back.”

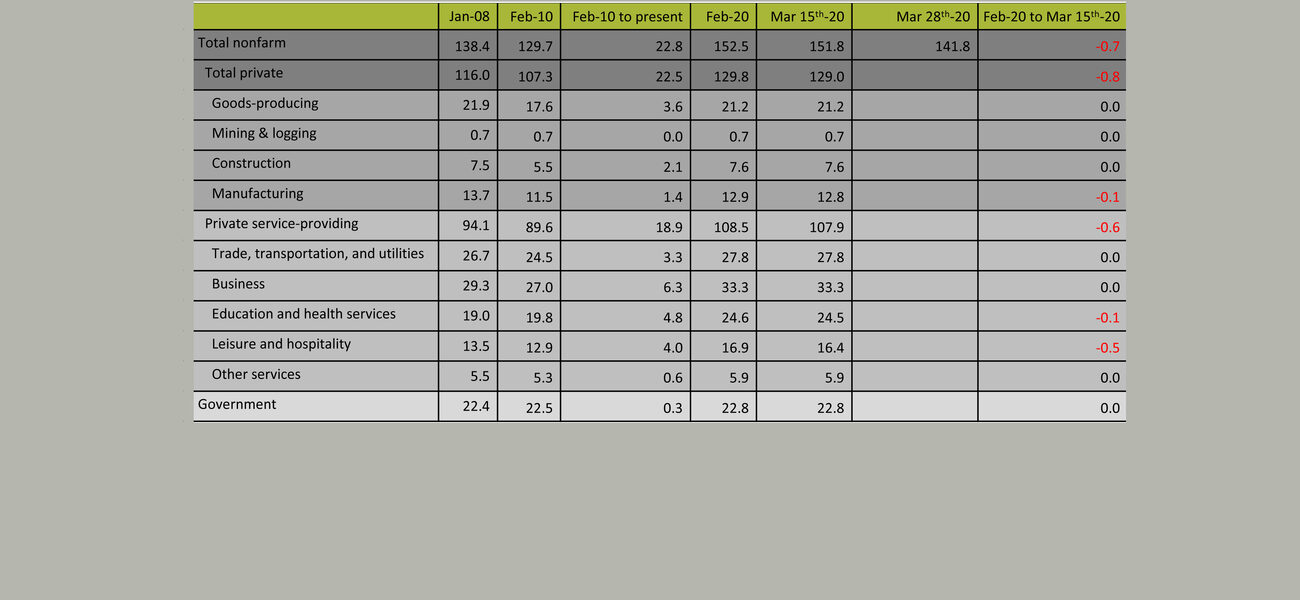

Employment figures released last week show that half of the 22.8 million jobs gained in the last decade were lost in a single month, with 17 million unemployed in the US, compared to 15 million a decade ago. And the trend likely will continue through April, says Vermeulen, when the impact on the construction sector will be clearer.

“This is a deliberate shut-down in place through April to get us to the other side of the pandemic,” he says. “We need to focus on all the efforts to keep everyone safe. In pre-construction, the entire team can work from home.”

Workforce

- Planning staff are working remotely to keep projects in the pipeline. This requires new communications protocols and an acceptance of shifting workday schedules.

- Shift work on the job site minimizes the number of people working together at a time, but also can increase the cost if they are paid a 10 percent premium to work after hours. At some job sites, the crews are not paid overtime to work on weekends, because their total number of hours doesn’t increase.

- Screening employees for COVID 19 is costly: 600 employees being paid $45 an hour taking 30 minutes to be tested costs $13,500 every workday.

- “There is lost momentum,” said the vice president of a major electrical contracting company. “I don’t see the energy I used to see when I walk a job site. There’s a loss of productivity.”

- Several major cities have halted most construction projects, which could be difficult to resume in the future. “The last thing you want to do is shut down a job site,” said CEO of a Texas-based general contractor. “That workforce will go someplace else, and you’re not going to get them back when you need them.”

- Attrition among subcontractors is not yet evident, but it seems inevitable as the national economy worsens and lines of credit become more difficult to obtain.

- One Texas university is working with a general contractor to develop procedures for virtual inspections, to avoid the large team that typically does a walk-through inspection.

- Subcontractors in Boston, where all “non-essential” construction projects have been paused indefinitely, organized an exercise program so workers would be in shape when they return to work. (They’d seen a spike in worker’s comp claims after they returned to work after the 2008 recession.)

Procurement

- Contractors should be procuring mechanical equipment earlier than they normally would to account for possible future lags in the supply chain and questions about the reliability of trucking. Early procurement would keep projects on schedule, but storage of materials may add to the cost.

- Owners have expressed a willingness to open the cash flow to make materials available earlier than the original schedule dictated, sometimes being willing to accommodate weekly in lieu of monthly draws.

- Supply chain issues are not very prevalent now, but Asian manufacturers might start to deplete their inventories in a month or two. They shut down eight weeks ago and are now back to nearly 100 percent capacity.

- “Some manufacturers were planning to shut down until they hear that we’re still working,” says a senior project manager at a Texas firm. “It is critical to get the message out that construction is moving forward and they should keep production going.”

Liability

- Subcontractor Default Insurance remains a superior product, according to the general contractor CEO.

- There is no general pandemic exclusion—you draft the bond forms; you don’t need to accept any other forms.

- Watch for endorsements or exclusions.

- Some subcontractors are starting to include “carona virus clause” in their bids.

Of those who responded to the AGC survey:

- 59 percent say they have experienced project delays or disruptions, up from 45 percent the week before.

- 35 percent have experienced shortages of materials, parts, and equipment, including personal protective equipment for workers (up from 23 percent the previous week).

- 28 percent report shortages of craftspeople (up from 18 percent).

- 16 percent say a shortage of government workers for inspections, permits, and other actions has led to project delays.

- 13 percent report that a project has been delayed by the presences of a potentially infected person.

City leaders in the San Francisco Bay Area, like in Boston and New York City, have halted construction projects deemed non-essential. But California’s Gov. Gavin Newsom said last week that he has no intention of imposing a statewide ban, because he is confident the building trades are taking the necessary steps to keep their workers safe, including taking temperatures at work sites, sterilizing tools and equipment, banning food trucks, and implementing strict protocols for social distancing.

While adapting to the new work environment may incur additional costs, it is not yet clear how that will impact construction pricing.

“The easy thing to do is say we should increase our fee, but we still have to compete,” says the electrical contracting vice president. “We may end up eating these costs. I’m not ready to say we should increase fees.”

By Lisa Wesel