The vast array of Internet of Things (IoT) technology on the market today can tempt facility planners to install the latest gadget just because it is available. IoT technology offers a variety of tools, such as sensors and software that can be added to furniture or other facility assets, to allow these assets to connect and exchange data using built-in wireless connectivity. But to what end? Brian Haines, vice president of strategy for FM:Systems, cautions planners to look beyond the allure of new technology and to carefully assess which sensor or combination of sensors will produce data that advances specific institutional goals or addresses immediate facility concerns.

“Installing smart devices will lead to workplace efficiencies, but only if the devices are tied to processes and technology that capture data that is then analyzed in meaningful ways,” says Haines. He adds that while there is no magic formula for measuring real-time utilization, the most valuable data obtained from sensors focuses on three productivity processes:

- Utilization rate, which is a function of both frequency and occupancy rates

- Frequency rate, which measures the proportion of time that space is used compared to availability

- Occupancy rate, which measures how full space is compared to its capacity

“Sensors placed on furniture, fixtures, and equipment should be aimed at collecting data that will measure the performance of assets and optimize space usage,” says Haines.

Controlling Sensor Study Costs

“Often organizations shy away from integrating IoT devices to collect data because they falsely believe the process will be too expensive,” says Haines. “In reality, installing sensors and receiving immediate feedback is usually easier and less costly than most facility managers think it will be, even for existing facilities.”

Haines explains that the practice of renting sensors is becoming very common and can drastically reduce the cost of sensor-based utilization studies.

“Rental agreements can be used for any type of sensor and can vary in length based on the type of study the company wants to conduct,” says Haines. “Rental fees are considered an ongoing operating expense in contrast to a sensor purchase, which can be a large capital expenditure if a study requires thousands of sensors.”

Companies doing a study using rented seat sensors receive a box of sensors in the mail from the supplier, then attach the sensors themselves to the furniture in question. At the end of the study, the sensors are taken off and mailed back to the supplier, who analyzes the data.

“There is no need for companies to change their internal computer infrastructure in order to use sensors, since the sensor supplier will use their own software to synthesize and analyze the data,” says Haines. “This is true for both sensors that are rented or purchased.”

He adds that overall, the cost of sensor studies has been reduced due to significant advances in sensor battery life and the growing number of sensors that require only ethernet cables to supply power.

“Just a few years ago, batteries used in small clip-on sensors for chairs and desks would last only about a month, making it extremely time-intensive and costly to replace the batteries, especially for studies involving thousands of sensors,” says Haines. “Now, sensors have a much longer battery life, averaging 10 to 12 years.”

The expanding availability of wireless networks, and the fact that almost everyone uses a smartphone, have also dramatically increased the ease and effectiveness of sensor-based studies in recent years.

Collecting and Interpreting the Data

Sensor suppliers, including FM:Systems and other cloud-based software providers, use software to run advanced analysis on the data collected from sensors in a way that cannot be done manually.

“In the past, people conducting desk occupancy studies would have to walk the floor several times a day to record when desks were occupied,” says Haines. “Instead, a furniture sensor does a check about every 15 milliseconds so it’s doing hundreds of thousands of checks per day.”

Haines adds that sensors are always working, since they never go to sleep, never call in sick, never take vacations or holidays, and can’t falsify reporting.

“The amount of data that sensors can collect can provide amazing insight but is also too overwhelming for people to process without the aid of computers,” says Haines. “To compensate for this, most software will take the data and create easy-to-read, color-coded charts that make the data understandable and actionable.”

Involving IT and HR

“Even though the software vendor will do the data analysis from the installed sensors, companies should never install any kind of sensor without first involving their information technology (IT) and human resources (HR) departments,” says Haines.

Because the sensors will connect to the internet, IT departments need to be involved from a security standpoint, to ensure that the sensors are installed properly in order to avoid having any unsecured devices linked to a corporate network.

And HR departments need to have a very clear privacy policy in place notifying employees about the use of sensors.

“If employees use a phone provided by the company, that phone can automatically connect to any WiFi-based sensor study,” says Haines. “If employees use their own phone, but also use corporate resources such as WiFi, the employee needs to sign a privacy policy stating they understand that logging onto the corporate WiFi serves as consent for the company to access sensor-based data through their personal phones.”

He points out that since younger employees entering the workforce are accustomed to providing information through the internet and WiFi-based systems, they are generally less concerned with workplace privacy issues than older workers.

Types of Sensors

Haines explains that most companies don’t use sensors to track the location of specific individuals or to get people in trouble. Rather the goal is typically to measure performance and efficiency of the overall facility using a variety of sensor categories:

Furniture sensors: In addition to seat sensors, battery-operated or hard-wired sensors can be placed on desks or any type of furniture. Most commonly used for utilization and density studies, these sensors measure either vibration or body heat using passive infrared (PIR) technology.

“Herman Miller now offers a line of electronically-enabled furniture with built-in Bluetooth to recognize users and adjust automatically to that user’s presets,” says Haines. “The desk can also be set to vibrate at specific intervals to remind users to get up and stretch or walk around.”

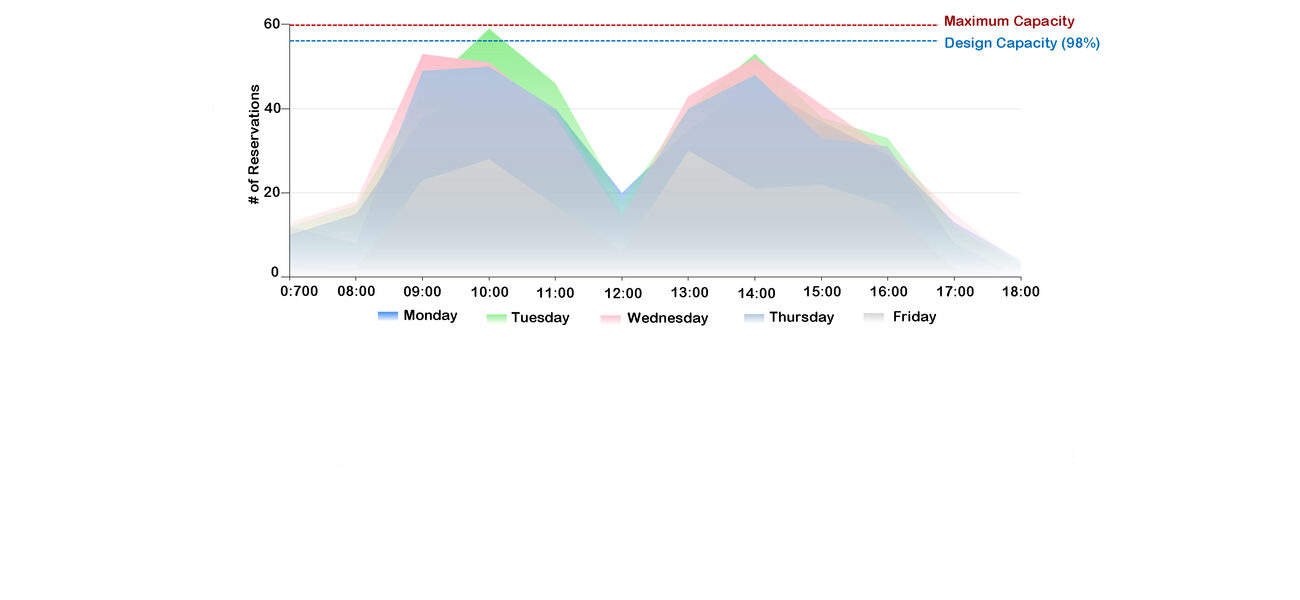

Room-booking sensors: Often used outside of conference rooms, these sensors provide digital signage that tracks room reservations and usage to help measure overall space utilization. The room-booking sensor can be accessed with a code, badge, or mobile phone to check into the room.

People sensors: This category of sensors includes intelligent lighting sensors and 3D stereoscopic sensors. Both of these technologies can be used to count the number of people within specific areas or occupancy zones.

Digital intelligent lighting sensors placed within ceiling fixtures can provide high spatial resolution and a universal view of the entire space. In addition to producing LED lighting that can be adjusted by color, these sensors also measure temperature and humidity and can count the number of people in a room.

A 3D stereoscopic camera positioned above the entrance to a room can count the number of people entering and exiting. This information, which can be saved in a database, allows facility managers to learn the average number of people using that space over time.

“There have been a lot of recent advances in 3D camera technology and the cost of cameras will vary based on the number of features included,” says Haines. “In general, the price of 3D cameras is quickly coming down, because the adoption rate is increasing.”

Haines adds that this technology is often used in retail settings and has even been used by the London Underground to count millions of people entering and exiting train stations.

Location-based geo-tracking sensors: These sensors can be described as an indoor GPS that monitors the position of all phones within a space. Using overhead WiFi access points, the geo-tracking sensors placed on the ceiling will triangulate the position of all connected phones and show the location of each one.

He adds that geo-tracking sensors can be very useful for tracking density of space usage and have even been used by some companies during fire drills to ensure that everyone has vacated a building.

Three Key Lessons

“Unlocking the value of IoT technology inside our facilities helps to better understand how people work within specific spaces,” says Haines. In summary, Haines highlights three key points:

- Not every occupancy sensor is created equal. Identify the specific problem that needs to be solved before selecting what type of sensors should be installed.

- Data without analysis can be interesting, but will only result in actionable intelligence if there is a method for synthesizing and visualizing the data.

- Installing sensors and receiving immediately feedback is easier and usually less costly than most facility managers think, even in older, existing facilities.

By Amy Cammell

| Organization | Project Role |

|---|---|

|

FM:Systems

|

Facility and Space Management Consulting

|

|

HELLA Aglaia

|

3D Stereoscopic Camera Sensor

|

|

Monnit

|

Wireless PIR Sensor

|

|

HermanMiller

|

Electronically-Enabled Furniture

|