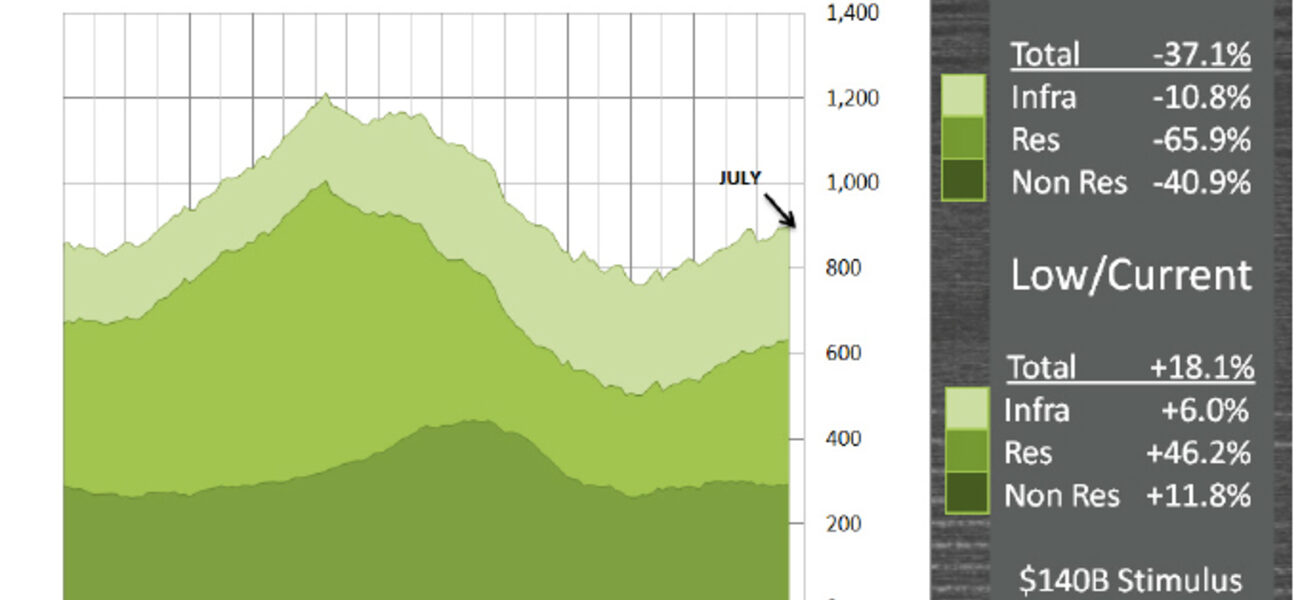

Capital construction costs for institutional projects will continue rising across much of the nation due to growing market strength, regional labor shortages, rising commodity prices, and an increase in mark-ups. Construction volume, the industry’s biggest cost driver, continued its steady increase—up more than 18 percent in the third quarter of 2013 from the bottom in March 2011. At the current rate of growth, construction prices will surpass the industry trend line in 2014, repeating long-term cyclical patterns.

According to Vermeulens, there is a range of procurement strategies that can help control the risk of escalation in light of current and expected market conditions. These include strategic early procurement packages, negotiating Guaranteed Maximum Price (GMP) contracts after the bids for the sub-trades are purchased, and continuing with design and preconstruction even if the funding isn’t in place.

Market Rebound

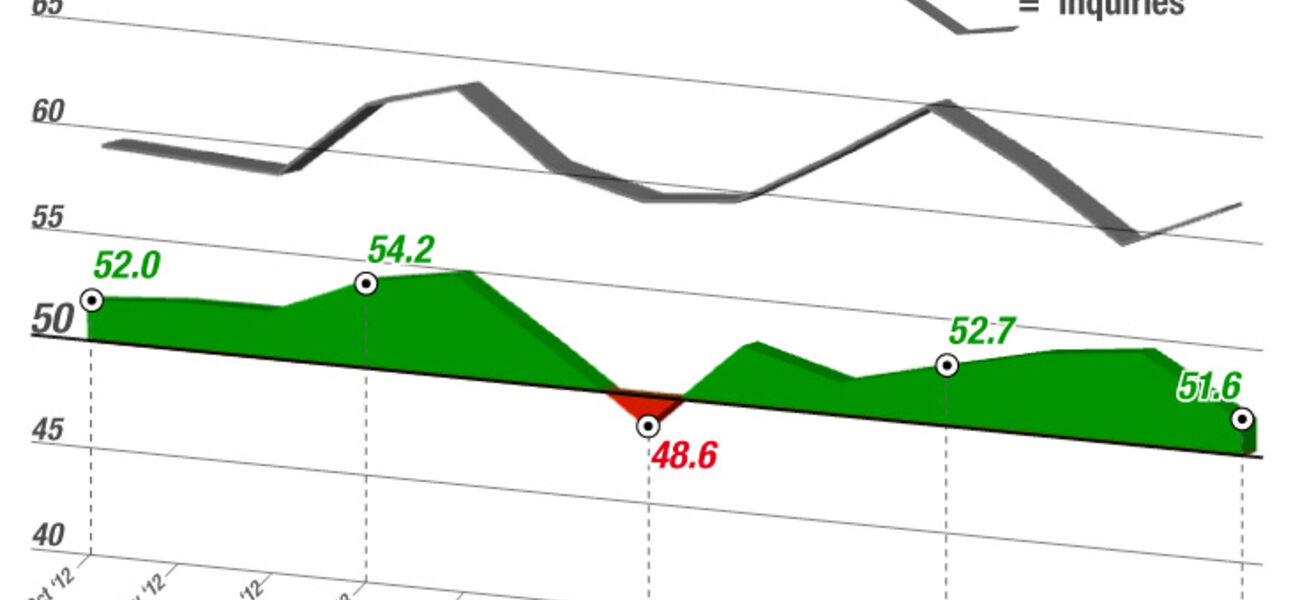

Following the recession, non-residential construction costs fell an average of 14 percent from their peak. They picked up 2 percent in 2011 and another 4 percent in 2012. Vermeulens’s projection for 2013 is 5 percent. This upward trend indicates that a market recovery has taken hold and will continue growing steadily for the near to mid-term.

Demand for commodities dropped at the beginning of the recession, which led to a reduction in commodity prices. A reduction in labor demand also meant that instead of having A-, B-, and C-level subcontracting teams on a project, the A team handles all the work, which leads to a cost savings from improved worker efficiency. Another big reduction in pricing came from reduced contractor markups.

“For example, a steel erector will have a crane and cables that they have to charge rent for, but they may forgo that charge in order to win a project,” says Blair Tennant, a project manager and cost engineer for Vermeulens.

These factors created a short-lived window of reduced construction costs that is now ending as commodity prices rebound, demand for construction labor increases, and contractors try to recover lost markups previously sacrificed to win bids.

Construction employment reached a high of 7.7 million jobs just before the financial crisis hit. Then the economy shed 2.3 million construction jobs, about a quarter of the nation’s total job loss.

“We haven’t seen a lot of labor return,” says Tennant. “But we have seen unemployment fall in certain areas. This is resulting in a shortage of labor in some markets that could cause challenges.”

Know Your Index

The projected amount of construction escalation depends on which of the three cost indexes you refer to—Engineering News Record (ENR), Turner Construction, or Vermeulens.

While many organizations use ENR to index projects, it is different from the other two because it is an “input index.” Since it measures escalation based on industry inputs, the ENR is a good index for subcontractors who want to know how much labor or steel is going up, but it doesn’t account for labor productivity or what the subcontractor charges after markup.

An output index, like Turner and Vermeulens, is better for owners and construction managers who want to predict actual project costs because they reflect what subcontractors are going to bid rather than the costs they experience.

Bidding Contingencies

Instead of carrying a flat percentage for project cost contingency, Vermeulens recommends construction managers and owners carry contingencies in different categories, such as project, design, construction, escalation, and bidding.

Bidding contingency comes into play in markets facing labor shortages.

“At Texas A&M, there is a $400 million stadium renovation taking place next to their veterinarian school,” says Tennant. “There is only one electrical contractor in town who can do the job. That is the only number they are going to get. So we started to carry a contingency on the bottom line for bidding risk.”

Bidding contingency—a trend that is growing as regional labor supplies becomes more strained—is eliminated as the subcontracts are “bought” at the start of construction. While booming markets merit positive contingencies, crashing markets require negative contingencies, typically ranging between 2 and 5 percent.

Procurement Strategies

There are procurement strategies that can help minimize the risks of cost escalation in the current market. One of these is engaging in a highly detailed concept and design phase that incorporates all potential ideas and stakeholders.

Vermeulens used this approach at the Dana–Farber Cancer Institute in Boston during a recent regional surge in construction. The team explored a range of different design options, different programs, and different building heights. The document packages for each design were 100 percent complete in advance. These detailed concept designs allowed Vermeulens to work with the construction manager to develop an accurate cost estimate and reconcile it to establish the right mix of programs.

An enabling package was purchased to take advantage of lower pricing. It included construction of the slurry wall and an underground parking garage. The enclosure was outfitted with steel, elevators, and design assist elements, while the full MEP and all interior elements were purchased later, with three mechanical bids coming in within $100,000 of each other on a $30 million project.

While strategic early packages can help avoid escalation, Vermeulens cautions against “cross-pollinating” packages. Cross-pollination of bid packages occurs when a trade is required in more than one scope of work. For example, a foundation bid package might require concrete and plumbing trades that are also required for the rest of the building. To avoid engaging more than one contractor, a foundation package could be limited to excavation and piling, so that concrete and plumbing can be bid when full packages are available for those trades.

Looking Ahead

Strengthening equity markets indicate strong continued growth, with a projected 6 to 9 percent annual increase in construction costs over the next two years, depending on location.

Early procurement packages with detailed documentation help control cost escalation risks. It also helps to have all estimates and schedules done before selecting a construction manager. Other strategies include continuing with design and preconstruction even when the funding isn’t in place. This allows projects to take advantage of current pricing and be a year or more ahead when the funding arrives.

For the first time since 2007, there has been a prolonged increase in construction labor, with the latest data showing increased labor in 30 states. According to Vermeulens, a continuation of this upward trend in job creation confirms an upswing that will lead to faster cost escalation in high-demand markets.

By Johnathon Allen

This report is based on a combination of the Vermeulens Q3 2013 Market Update and a presentation by Blair Tennant and James Vermeulen at the Tradeline 2013 Academic Medical and Health Science Centers conference.